As a global leader in the worldwide avocado business, we keep an eye on the growing popularity of avocados around the world. We source the World’s Finest Avocados™ from 13+ premium growing regions and deliver to 27 markets of distribution. Hot on our radar is Europe, which reached record import volumes in 2023!1

Mission’s global network includes two state-of-the-art ripening and distribution centers in England and The Netherlands, so we’re taking a look at the global avocado market– and what’s driving exciting growth in Europe.

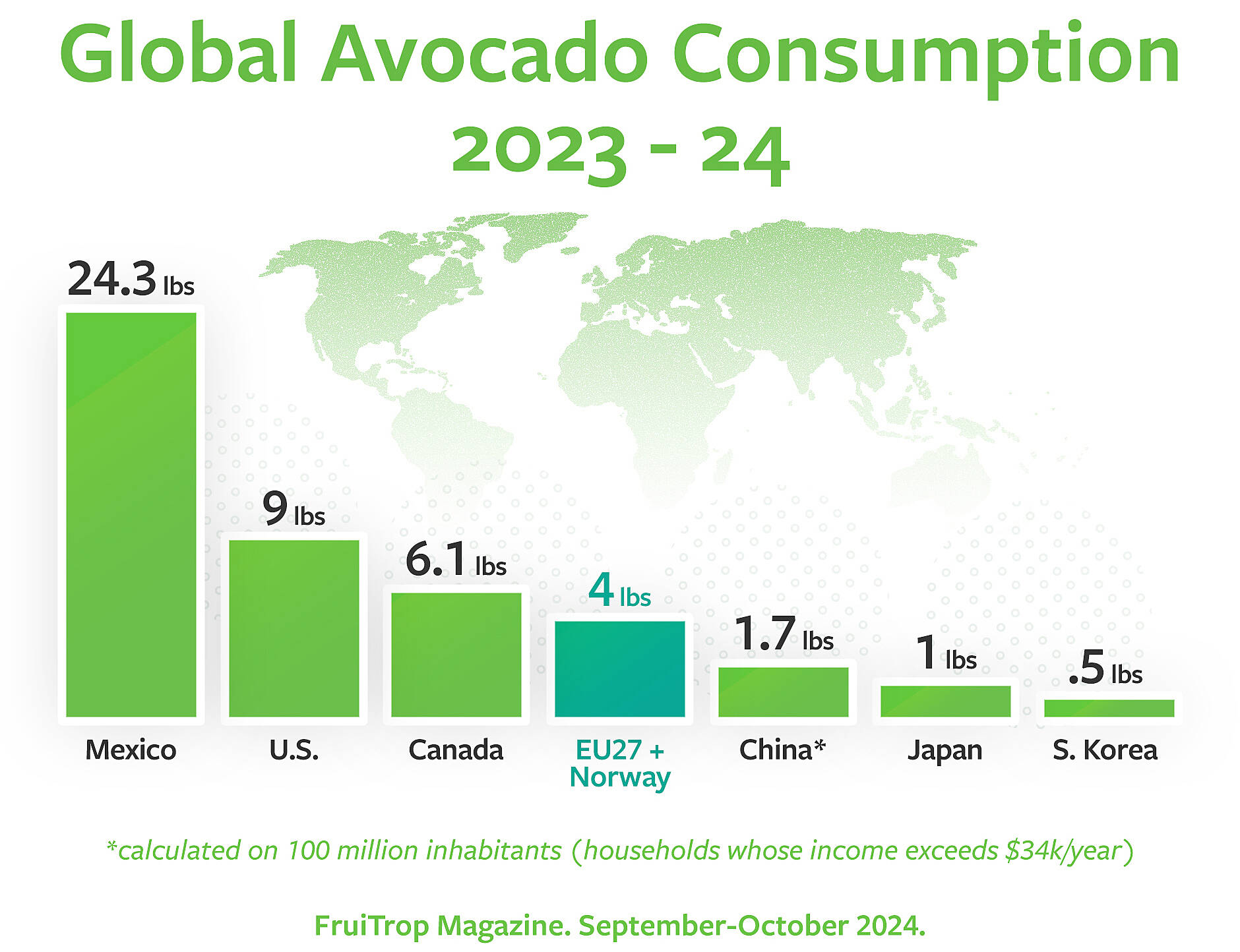

What Does Avocado Consumption Look Like Around the World?

- Mexico continues to lead as the #1 country for avocado consumption! With per capita consumption at more than 24 pounds, each person in Mexico is eating more than 48 avocados a year!

- While the U.S. has reached a steady 9 pounds per person per year, consumption ranges regionally– the West is as high as 13lbs, while the Northeast is almost half that at 7lbs.

- In Canada, the EU27 + UK + Norway, and China, consumption has inched up about a half a pound since 2022.1,

- Consumption in Japan and Korea has slightly declined since 2022.1,2

Growth Potential in Europe and Mission Produce UK and EU

More than one-third of global avocado imports are going to Europe, and those imports keep growing!1 With ripening and distribution in both the UK and The Netherlands, Mission Produce is strategically positioned to serve a majority of the European market. We’re not only watching the growth drivers behind this uptick in consumption, but we’re contributing to it.

What is Driving Consumption in Europe?

- Increasing Year-Round Supply

As production increases, so does supply for the European market. Europe’s top avocado origins (Peru, Colombia, Kenya)3 have yet to realize their full production potential. Case in point: Mission Produce’s vertically integrated farms in Peru are still growing to peak production, and we’re still planting on our other partnered farms in Colombia and South Africa! So, as these new trees grow and develop, more avocados will be available to match consumption growth. - Ripening

The fact is: consumers want avocados that are ripe and ready to eat. We’ve seen great success in the U.S. with ripe avocados– some retailers have achieved up to a 62% annual dollar increase in sales on a Mission Produce Ripe Program!4 So, we invested in state-of-the-art technology, perfected our ripening process, and brought it to Europe to repeat our success overseas. We believe that the availability of ripe avocados will inspire more avocado purchases! - Avocado Health Marketing

The avocado’s healthy reputation is serving itself well across Europe. According to the Centre for the Promotion of Imports from Developing Countries (CBI), consumers in Europe are becoming more aware of health issues and pay more attention to their diet.5 So, in places like the UK, where there is a growing interest in plant-based diets, avocados are promoted for their good fats, fiber, vitamins, and minerals.5 And in Germany and Austria, consumer attention on quality nutrition contributed to a 12% avocado volume increase during the 2023-24 season.1

It’s an exciting time to be in the avocado industry, and Mission Produce is well-positioned to grow with rising global demand. With the great growth potential in Europe and globally, Mission Produce continues to grow supply and expand distribution, well positioned for opportunities to drive the consumption of our World’s Finest Avocados™.

Interested in what Mission Produce can do for you overseas?

Email MPUKSales@missionproduce.com (United Kingdom) and MPESales@missionproduce.com (Europe). You can also find Mission Produce at Fruit Logistica Berlin from Feb. 5-7, 2024, at booth C-34 in Hallway 25.

1FruiTrop Magazine. September-October 2024.

2FruiTrop Magazine. May-June 2023.

3Global Avocado Update 2024. Rabobank. June 2024.

4IRI YTD Through 2022. 9.18.2022.

5The European market potential for avocados. CBI (Centre for the Promotion of Imports from developing countries). Jan. 17, 2024. https://www.cbi.eu/market-information/fresh-fruit-vegetables/avocados/market-potential.