In this issue of the AvoIntel™ blog we share a 2023 Avocado Category Year-in- Review, plus a few of the expected Consumer Trends for 2024. Please consider this information as you plan your category mix and reach out to us if you would like more specific information for your business planning.

U.S. Avocado Category – 2023 Recap

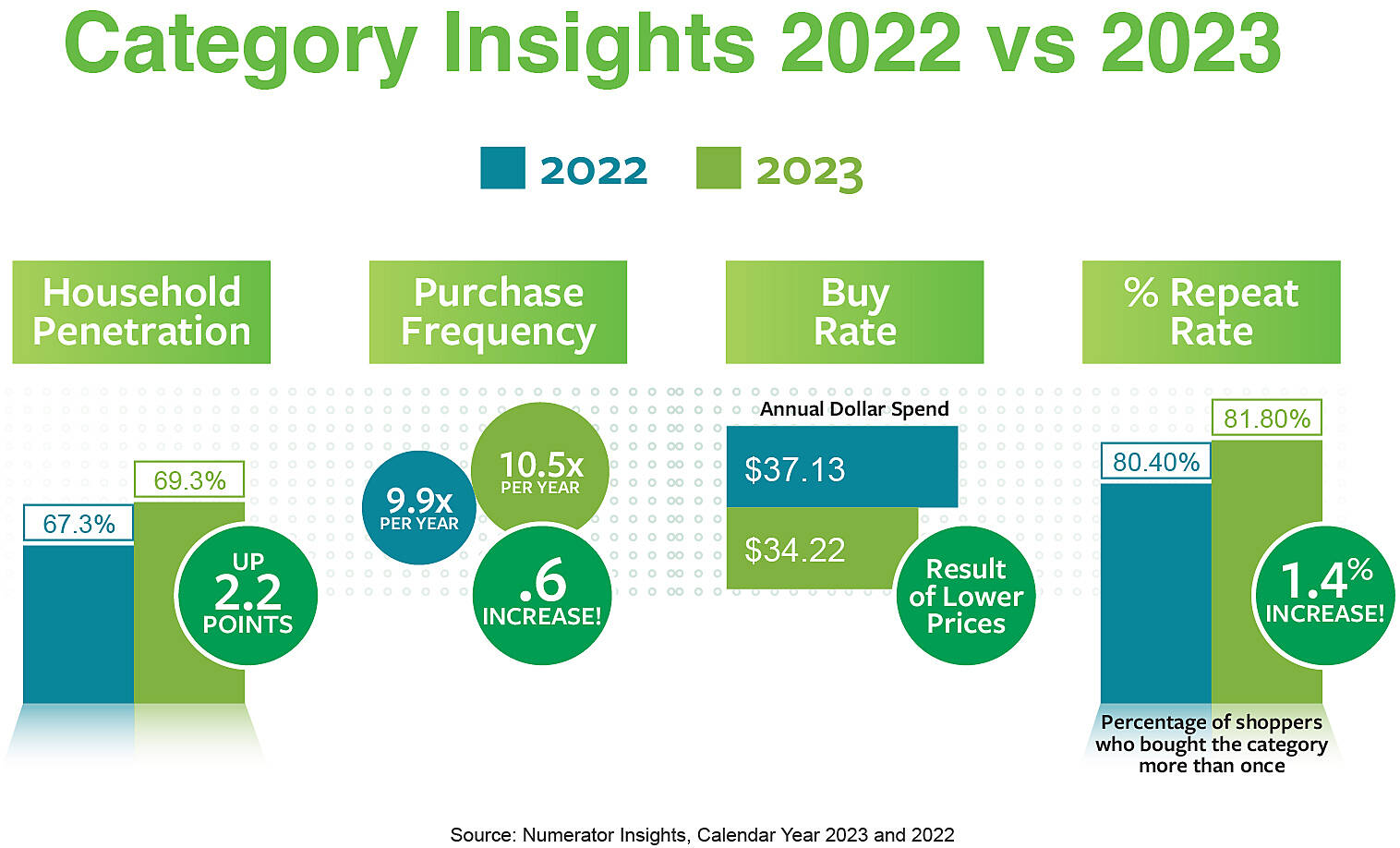

In 2023, the avocado category bounced back and saw per capita consumption increase to an estimated 8.7 pounds, up nearly three-quarters of a pound vs. 2022.1 Household penetration hit 69.5%, placing avocados ahead of other produce powerhouses like blueberries (67.1%), broccoli (64.7%), and mushrooms (61.4%).2 On average, shoppers purchased avocados 10.5 times last year, putting avocados among the top 5 most frequently purchased produce items!2

At retail, avocado volume lifted 7% year-over-year.3 A larger supply helped ease prices down 16% from 2022 and opened the door for more shoppers to enter the category.3 Promotions remained a key driver of avocado sales with 43% of volume sold on price reduction, up 7 points from 2022.3 Shopping sales continues to be the most popular money-saving tactic among consumers.6

AvoIntel™ 2024 Consumer Trends

While recent headlines have touted slowing inflation rates (just 3.4% in December!), the fact is prices are still up 30% from 2019.4 Wages are also on the rise, but at 18% growth, haven’t kept pace with inflation.4 This means that consumers are still highly uneasy with the economy with 74% expressing concern over rising prices on essential goods and services.5

A recent study from Numerator found that functional foods will continue to gain momentum in 2024 as consumers seek nutrition through their diet.7 Avocados are well positioned to have another “moment” outside of just guac and toast as long as the nutritional message is clearly communicated.

Circana estimates that 78% of meals were prepared at home in 2023, highly elevated from 53% in pre-Covid 2019.6 While reducing restaurant spend is a common cost-cutting measure, consumers still want to treat themselves with affordable indulgences. Numerator reports that LSR (limited-service restaurant) visits were up 13% YoY in November.7

For more category insights connect with our AvoIntel™ team at Marketing@MissionProduce.com.

1Estimate based on U.S. population from census.gov and Hass Avocado Board import volume data

2Numerator Shopper Metrics, Total U.S., Calendar Year 2023

3Circana, Total U.S. MULO – Calendar Year 2023

4Circana SNAP’s Wallet Squeeze and Opportunities for Growth, January 2024

5Numerator Consumer Sentiment Study, Dec 20, 2023

6Circana December 2023 Shopper Survey

7Numerator Visions ‘24