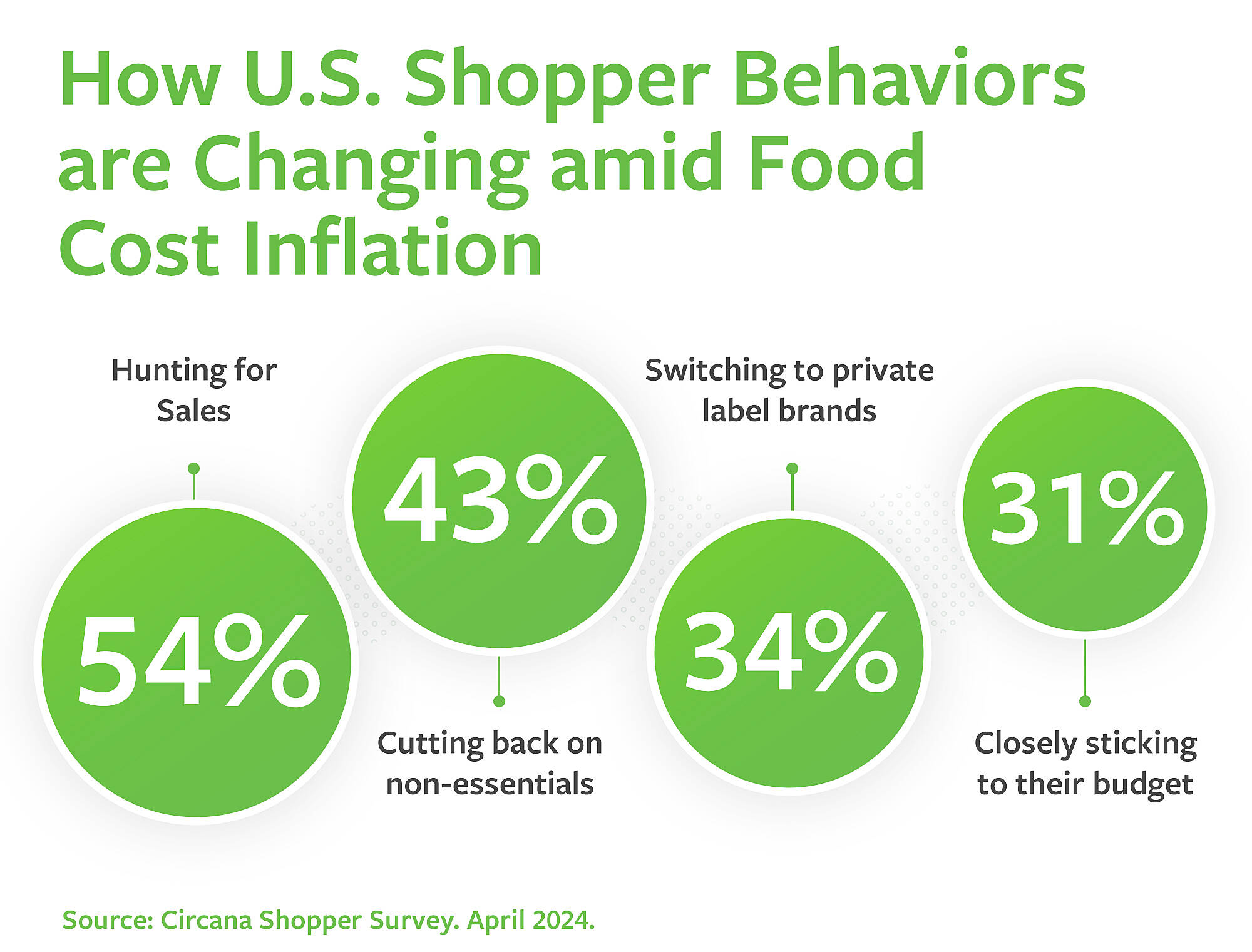

In the world of avocados, fluctuating prices and supply volatility is nothing new– but in today’s economic climate, retailers face increasing pressure to address the 95% of shoppers who are voicing concerns over food cost inflation.1 As of March 2024, a staggering 80% of shoppers have been making changes to their shopping behaviors,1 and this edition of AvoIntel™ aims to arm retailers with the data-driven strategies to keep avocados in baskets.

The Bad News: Avocados prices have surged, climbing 24% higher than 2023 prices.2

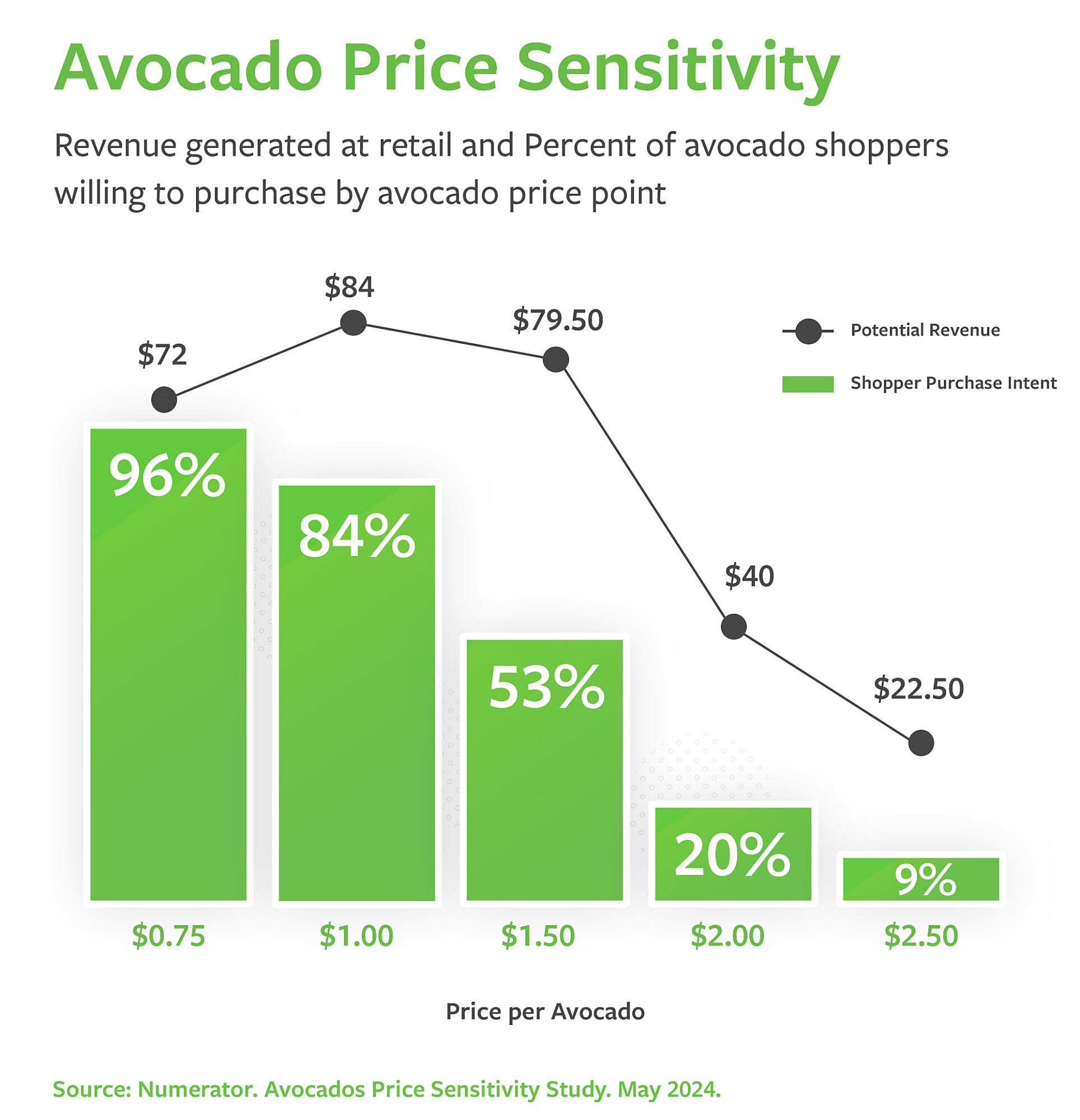

The Good News: Data shows that there is a pricing sweet spot when 84% of avocado shoppers are willing to part with their dollars for an avocado3 – while still driving retail revenue.

Because price is an obvious key factor in a shopper’s decision to purchase an avocado,3 we conducted a price sensitivity study to gain a deeper understanding of the relationship between rising prices and consumer purchasing behaviors.

We found that a shopper’s intent to purchase an avocado generally meets a retailer’s peak revenue at the pricing sweet spot of $1.3 Once pricing increases to $1.50 for an average-sized avocado, purchase intent is found to drop considerably, while revenue remains strong.3 Increase the price to $2 an avocado and both purchase intent and revenue dramatically decline.3 These results are representative of avocado shoppers that purchased avocados from a retailer at least two times in the months from March-May 2024, but results varied according to avocado characteristics, geographic region, and shopper demographics such as age and income.

The Solution: This summer, give avocado shoppers the price they’re looking for by implementing Mission’s data-driven strategies:

- Size down. With this season’s smaller size curve, the supply of small avocados is plentiful. By sizing down, a retailer can capitalize on the lower pricing of small fruit and satisfy the pricing sweet spot for their shoppers.

- Offer digital coupons. 27% of avocado shoppers are looking for deals and coupons, and another 30% are comparing prices before even stepping foot in a store.1 By staying apprised of promotional opportunities, a retailer can capture more price-conscious shoppers.

- Consider alternative sources and sizes to maintain steady pricing. Mission Produce is dedicated to delivering the world’s finest avocados– where we find them, and how big they grow is up to mother nature!

The right pricing strategy will differ from store to store, but Mission Produce has the AvoIntel™ to drive avocado category growth with your shoppers’ best interests in mind, and the supply to keep shelves stocked.

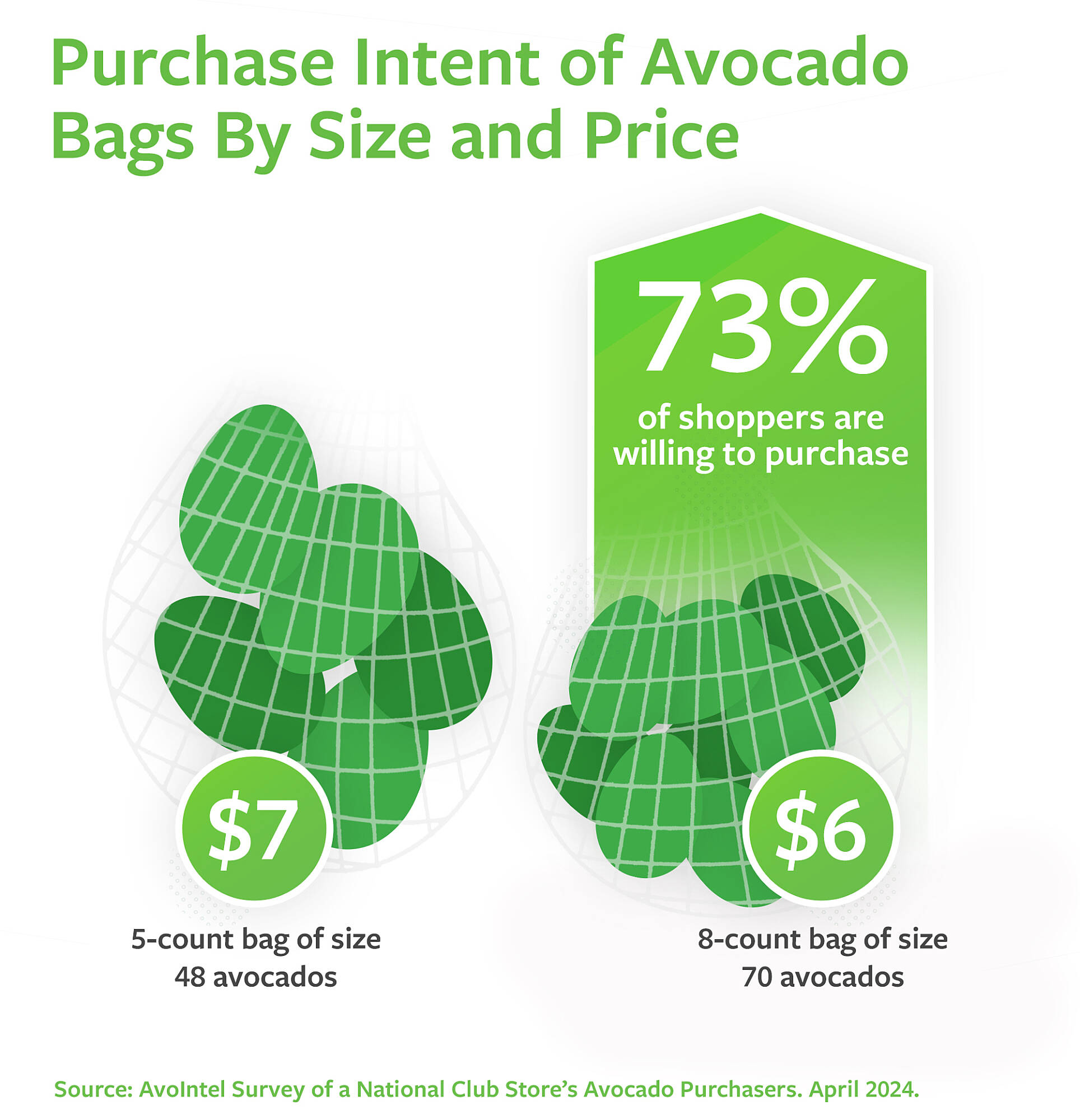

The Case Study: We recently put our strategy to the test with a customer that witnessed a drop in unit sales of 40% when prices of their 5-count large avocado bags jumped from $5 to $7.4 Would sizing down be an option to redeem their bottom line and meet the demand of their shoppers? We ran a survey to find out, and sure enough, 73% of the store’s avocado shoppers were willing to purchase an 8-count bag of smaller avocados at a price point closer to the dollar sweet spot per avocado.5 It seems this season’s size curve is providing opportunities to grow avocado sales with both bagged and bulk avocados alike, despite food cost inflation.

Want to learn the pricing sweet spot for your store? Contact SalesReps@missionproduce.com to see how Mission Produce AvotIntel™ can support your avocado category.

1Circana Shopper Survey. April 2024.

2Circana, Total U.S. MULO+, 4 weeks ending June 2, 2024.

3Numerator. Avocado Price Sensitivity Survey. May 2024.

4Circana. Unnamed Store’s Bag Sales by Week. January 2022- April 2024.

5AvoIntel Survey of an Unnamed Store’s Avocado Purchasers. April 2024.